Thousands of Over 55s Are Releasing Equity from Their Home – Here’s How To Join Them

> There’s a reason why huge numbers of homeowners are unlocking tax-free cash from their property – find out why.

Last updated: July 2021Nearly 80,000 UK residents used Equity Release to take cash (equity) out of their home, tax free in 2021. This represents an increase of 24% compared to 2020 in Equity plans1.

Equity Release is a fantastic financial planning option that helps those in later life to live securely. This type of product truly enables over 55s to live their life exactly how they want, which is a welcome change from scrimping and saving to cover bills and bare essentials.

Simply put, Equity Release enables individuals to top up their retirement funds without adding years to their careers, selling property or even downsizing. For most, a tax-free disposable income is the dream when it comes to retirement living and Equity Release allows people to do just that.

Equity Release Calculator

See if Equity Release is right for you. Select your age range below, use the free Equity Release Calculator and discover how much you can unlock.

How does Equity Release Work?

Well, the huge benefit with Equity Release is that it can be used for any purpose. This tax-free money can be spent however you wish, and you have the option to access it as one huge tax-free lump sum or instalments.

The most popular type of Equity Release is a Lifetime Mortgage. With this product, it is paid off when you pass away or when you need to move out of your property into long-term care.

It is secured against your home and gives you the chance to still leave behind an inheritance for your family. There may be the option of Inheritance Protection Guarantee alongside your Lifetime Mortgage too, which essentially allows you to save a portion of the value of your home as an inheritance.

As with many financial products a lot of misinformation exists about the benefits and conditions of Equity Release. To give you a better understanding, here are the facts:

- You are eligible even if you still have a mortgage

- You are eligible if you are aged 55 or over

- You still retain ownership of your property

- You are eligible if you are a UK homeowner

- You can guarantee no negative equity

- Your payout will be tax-free

- You can still provide property inheritance value

- You won’t have to move home

- You can agree fixed interest rates

- You can use the payout however you wish

To get started, you just take two simple steps:

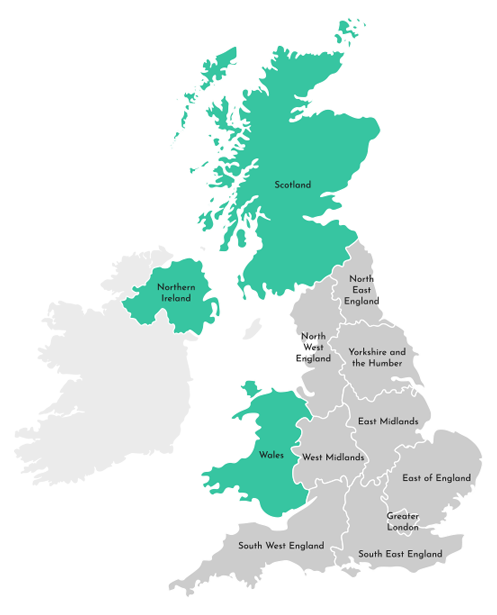

Step 1:Select your region on the map below to check your FREE quote

Step 2: Answer a few simple questions and compare your free quotes from the UK’s top providers